The Roundtable has become the heart of Citizen Journalism: A place where censor-free balanced debates take place daily, covering the world's most polarizing and important topics.

- Purpose: No Bias, No Echo Chambers

- Weekly Listeners: 10M+

Special Guests

Elon Musk

Special Guests

Nouriel Roubini

Special Guests

Hunter Biden

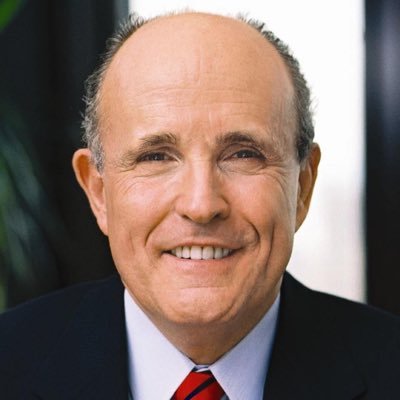

Special Guests

Rudy Giuliani

Special Guests

Marc Andreessen

Special Guests

Mick Mulvaney

Special Guests

Bill Ackman

Special Guests

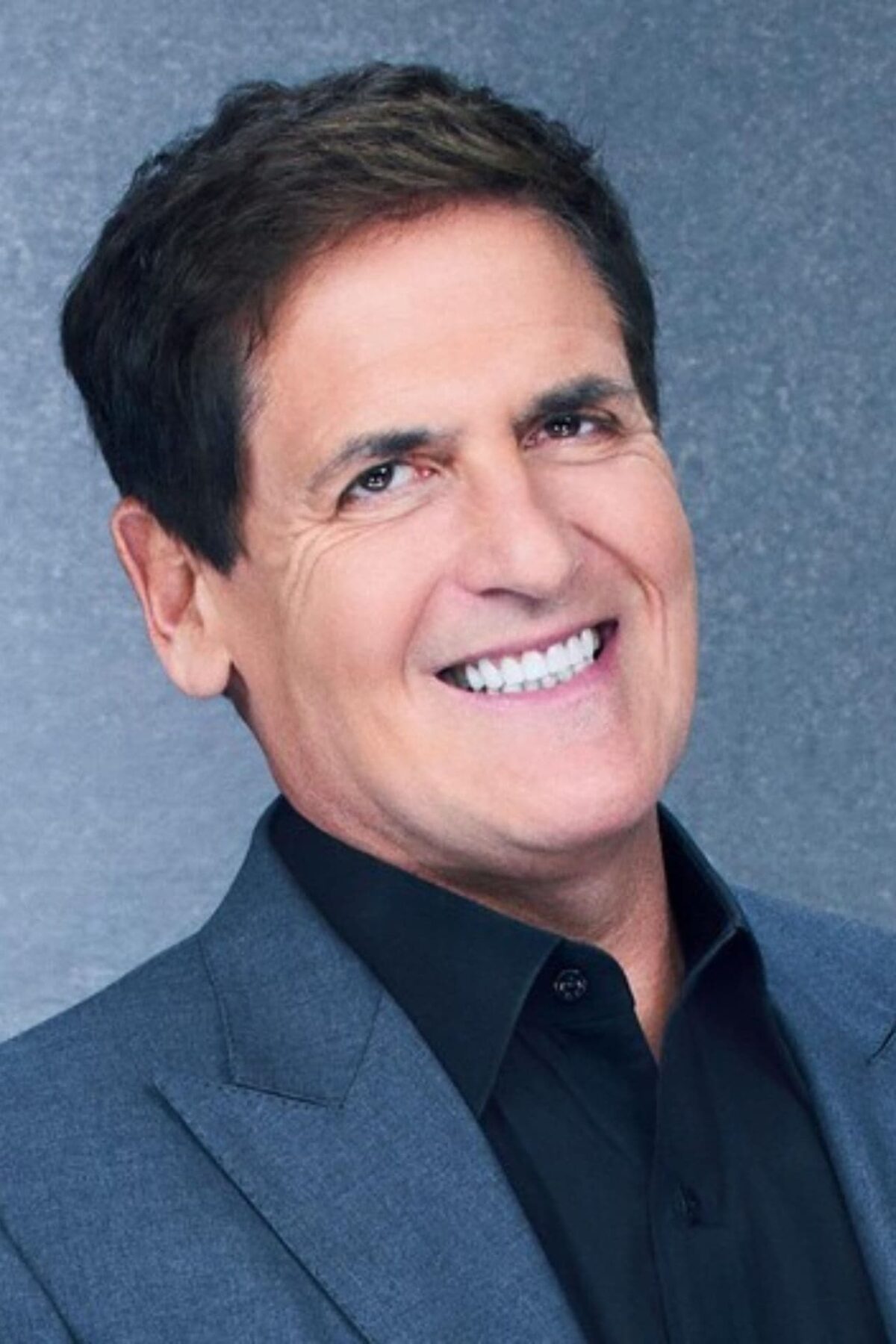

Mark Cuban

Special Guests

CZ

Special Guests

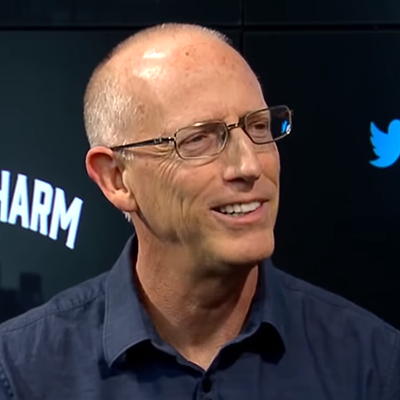

Scott Adams

Special Guests

Dr Drew

Special Guests

Andrew Yang

Special Guests

Anthony Scaramucci

Special Guests

Vivek Ramaswamy

Special Guests

Michael Bay

Special Guests

Thomas Massie

Special Guests

Lauren Boebert

Special Guests

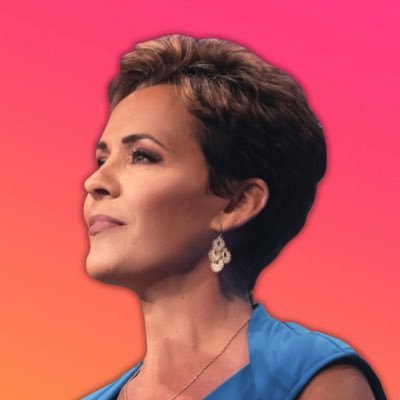

Kari Lake

Special Guests

Eric Weinstein

Special Guests

Patrick Bet David

Special Guests

Alex Jones

Special Guests

Tucker Carlson

Special Guests

Marianne Williamson

Special Guests

Andrew Tate

Special Guests

Mike Flynn

Special Guests

Mark Andreesen

Special Guests